GM readers,

We hope you had a wonderful Thanksgiving! We know the last few weeks / this last year have been chaotic in Web3, tech and overall. Today, we take a step back and use the holidays as an opportunity to reflect.

We recently had the pleasure of writing with Dan Herrera, who is a co-founder of e26c, an emerging VC firm investing in diverse founders across emerging tech and markets.

Today we explore the topic of chaos. Not only to understand it, but also to think about the opportunity that chaos can represent.

Contributing Writer: Dan Herrera

[LinkedIn]

Dan is co-founder of e26c, an early stage VC. He is currently launching his VC fund to invest thematically in outlier founders and the evolving internet.

He recently graduated with his MBA from Columbia Business School. Dan remains involved with the CBS community, having had the honor of being selected as a member of CBS's Young Alumni Board.

Before matriculating at CBS, Dan was the Director of Investments at Miami Angels VC, Florida’s largest and most active venture capital syndicate. Prior to that, Dan was Chief of Staff and a founding team member of a venture-backed, technology startup transforming the traditional taxi industry in Mexico City, having been acquired in 2018. In his early career, Dan was a management consultant at the global consultancy, Kearney.

📈 Life in Color Tip:

Follow us on Twitter to get the TL;DR as a Tweet Thread. 🐦🧵 🧶

+ Subscribe below 👇

The world is full of chaos all the time.

Change is the only constant has never been more true in this day and age.

Chaos often feels scary, and if you ask the average person, their advice is probably to avoid it.

And it’s hard to go against this line of thinking, after all the definition of chaos is complete disorder and confusion. 🤯

While chaos feels unpredictable, it’s also inevitable — particularly in the early life cycle of anything — the universe, startups, technology, etc.

Chaos is more prevalent in the early cycles because more aspects of that thing are undefined, which means there is more uncertainty that can lead to disorder and confusion. These things are usually labeled as emerging.

For example:

Emerging Tech (Web3): Building the next iteration of the internet

Emerging Investors (1st time VCs): Developing the craft of picking winners and avoiding losers

Emerging Markets (LATAM and high growth markets): Working in markets with different business and societal structures compared to established markets

While all of these emerging sectors are chaotic, they also present opportunity.

Emerging chaotic things

Why is anything “emerging” uncomfortable?

Emerging countries, sectors, etc. have one thing in common: they’re all not proven yet.

For the emerging examples above, we have to confront complex questions like:

Emerging Tech: how do we get people to understand Web3 as a technology, a business model and a movement?

Emerging Investors: how do we convince others to invest with us, and how do we convince founders to let us invest in them?

Emerging Markets: how do we enable founders in markets like LATAM to prove their credibility to investors who are used to investing in a different archetype in other markets?

Each of these lends itself to lots of change, innovative thinking and as a result, a chance for failure. Because there are no frameworks, uncertainty makes it uncomfortable to run toward emerging sectors. Everything feels situational: what works in one scenario seems to break in another.

This uncertainty adds an extra layer of complexity. The risks are high.

But in life, you get rewarded for being early and enduring / overcoming the pain that comes with uncertainty and chaos.

In emerging tech, you get rewarded for creating new ways of doing things.

As emerging investors, you get rewarded by doing something different than other VCs.

In emerging markets, you get rewarded when you bet early on an underdeveloped market.

In short, people who embrace change and explore new ideas usually reap the rewards of emerging chaos the most.

The irony of running away from chaos is you also run away from the opportunity that chaos brings.

Chaos as a spectrum

Chaos comes in all shapes and sizes, in varying magnitudes. Running a busy household vs. the FTX meltdown are obviously very different scenarios. But at heart, they can both produce outcomes that are crucial to get right.

Not only is this true to minimize downside, but from an opportunity lens, the outcome has the potential to be really good… or not, depending on how you manage the situation.

What determines the level of opportunity? Said another way, how do we know which emerging areas of chaos we should focus our time and energy on?

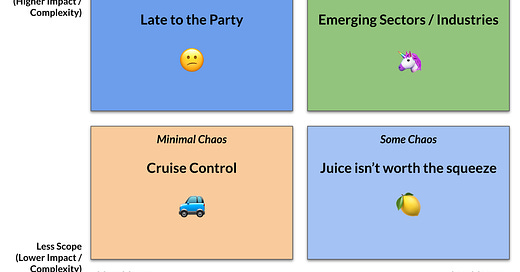

Viewing Chaos as a spectrum, we can picture two axes:

Scope (Impact + Complexity): how wide-ranging is the potential impact of the situation? How complex is it? (e.g. multiple stakeholders, with a lot of second-order effects in emerging markets impacting a large segment of people / market vs. single stakeholder, ring-fenced problem with minimal second-order effects, impacting a small market / segment); and

Maturity: how early on / emerging is this space?

(Upper Right, Highest Chaos) This quadrant defines earlier life cycle projects where no frameworks exists and have a high scope (potential for wide impact with complexity). This defines the most chaotic situations. 🏆 🦄

(Upper Left, Some Chaos) The chaos in this quadrant comes from the situation’s scope (i.e. situation is complex and has a wide ranging scope of impact). Because the context is established (not a new problem), there are likely some playbooks… capturing the opportunity here is about execution risk.

(Bottom Right, Some Chaos) The chaos in this quadrant arises due to the situation existing in an industry / context that is not tried and tested (i.e. early in its life cycle). However, due to its lesser scope of impact, the opportunity is limited.

In short, the situations with the most chaos are also the situations with the most opportunity. 🏋️♂️💪🏋️♀️

Beauty in Chaos

Okay, so we know disorder and uncertainty can be painful.

But chaos can be and is a good thing. Why? 🤔 🤯

Because it breeds innovation.

People usually stick to what’s comfortable — blind to new ways of doing things because of habits formed through past experiences.

But chaos is a chance to reinvent.

Any sort of process that changes with time (e.g., evolution, corporate survival, new technologies) replaces earlier primitives (organisms, companies, old technologies) simply because they were willing / had to change, where others wouldn’t.

So the opportunity in chaos lies in bringing order to it and understanding it. Some of us benefit and thrive from the chance to take risks because you need it to grow.

And chaos can be really important because without it, people don’t care. We’re more likely to revere “success” stories where the hero / founder / leader overcame adversity than the smooth sailing ship.

That’s what makes them a success in our eyes.

Chaos is a necessary ingredient on the road to success. The hero’s journey is defined by overcoming chaos.

Running toward Chaos

We started Life in Color thinking about change.

Since then, we’ve explored how emerging technology and principles like Web3 will change how we work, how we interact and how we identify ourselves.

We’ve internalized that if you want to organize around new primitives, new ideas, new ways of working… you need to bring order to the chaos.

The old adage of When life gives you lemons is about making the best of unexpected events.

The paradox of chaos is that chaos is a key ingredient for value creation, success and reward — the chaos of opportunity and the opportunity in chaos.

☯️

So, when life gives us lemons…

Many of us want something else. Some of us make lemonade. A few of us will become lemonade tycoons.

Run toward chaos.

Great write up on Chaos. Those who can spot pattens in chaos, they make the most.