GM Readers!

Sharing an essay I wrote for my Evolving Internet Insights Newsletter unpacking the rise of Coreweave, a startup AI cloud platform that is competing with tech giants like Amazon, Google and Microsoft.

-LJW

(P.S. For the summary and further breakdown of this essay, follow me on Twitter)

🚨New Newsletter🚨:

Launched a new short form weekly newsletter where we cover the week’s top emerging tech stories and add our insights on top.

Read Issue #9 👉 [HERE] 👈

And remember to SUBSCRIBE 🙏

P.S. Life in Color is not going anywhere :)

Note: Some sections of this essay were originally released on my Evolving Internet Insights newsletter.

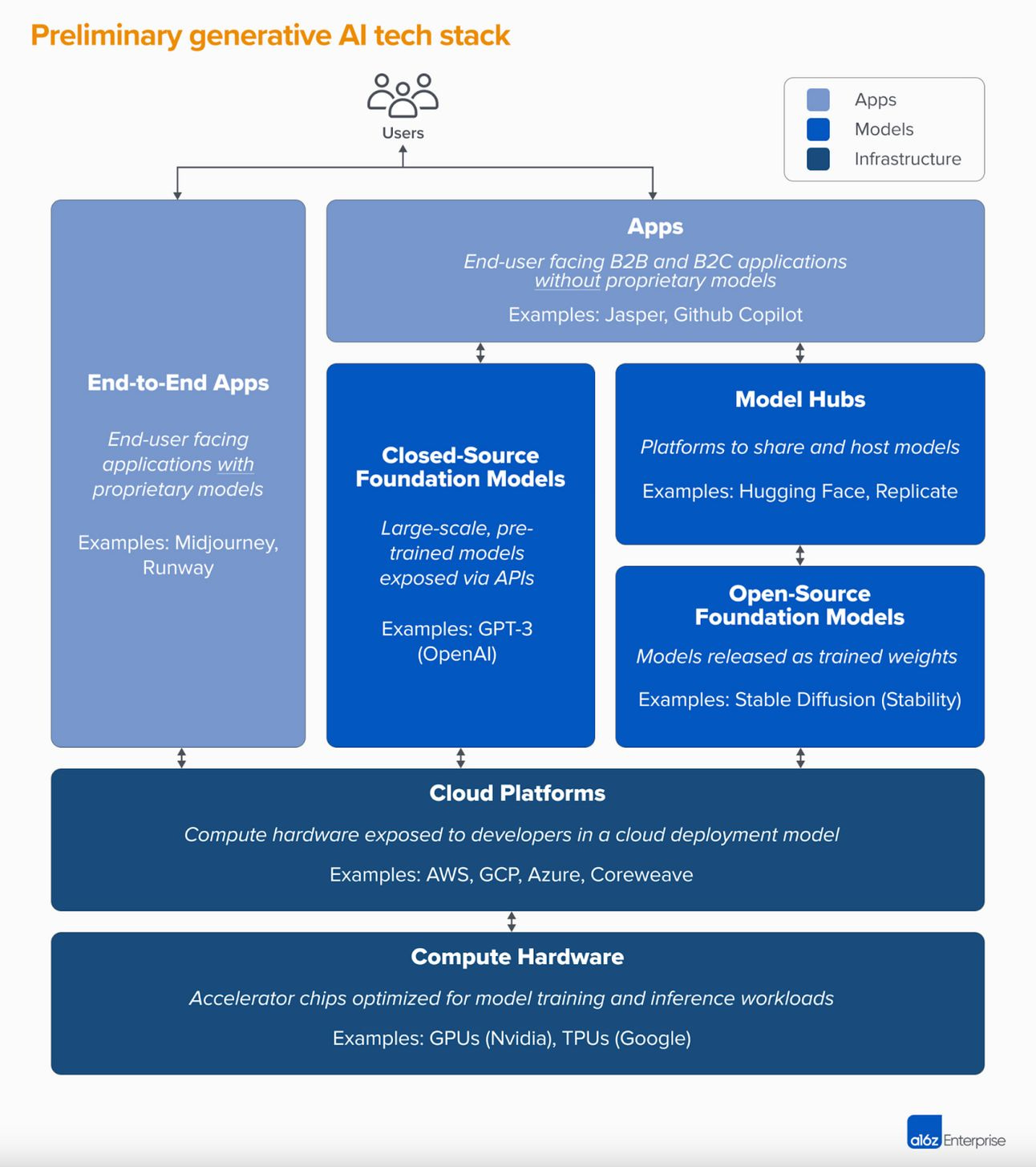

With the AI space heating up, both newcomers and incumbents are racing to the scene. Within the Cloud Platform segment (see the a16z graphic below) there is a David and Goliath battle brewing between CoreWeave (the “David” 🧒) and Amazon, Google, and Microsoft (the “Goliaths” 🧌).

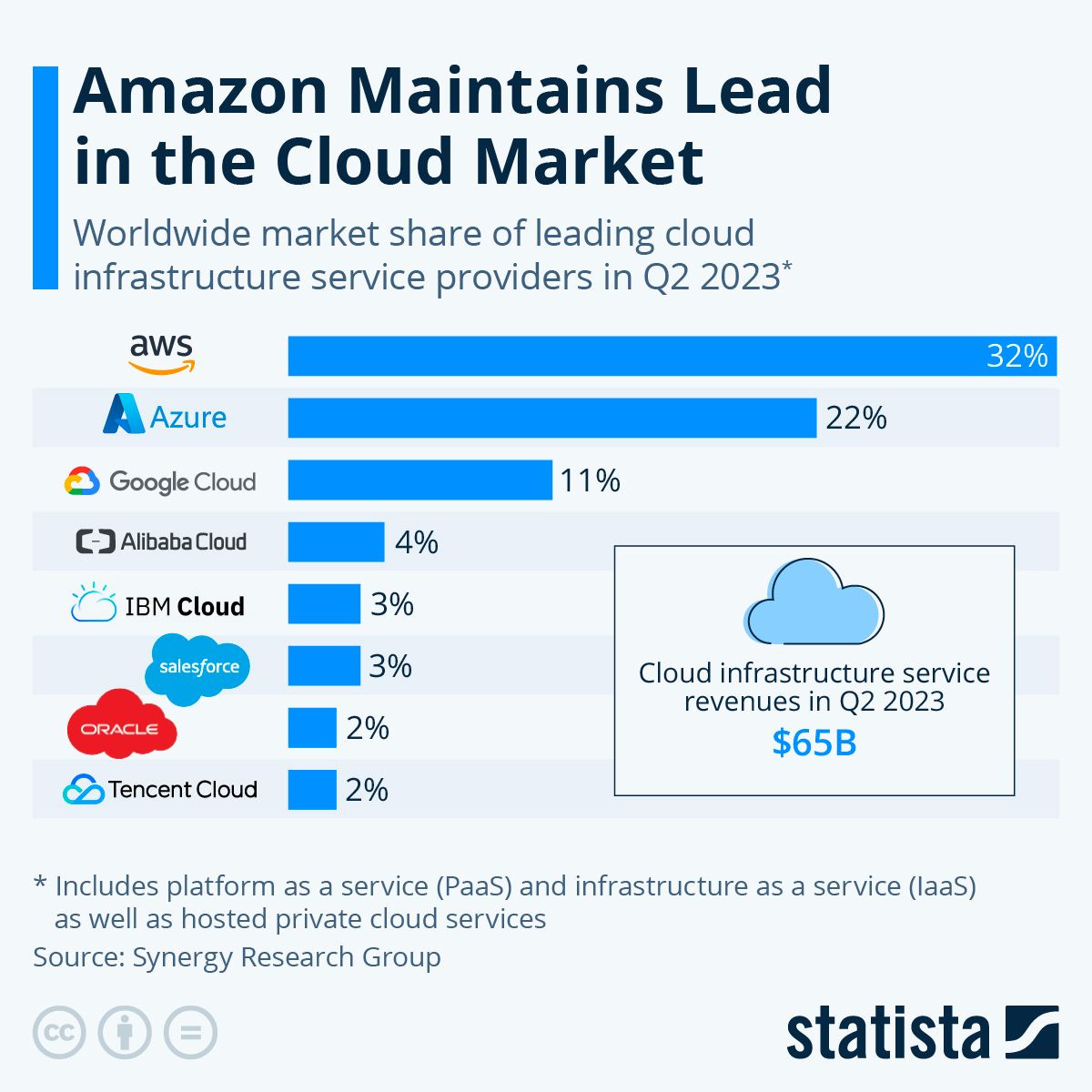

In the Gen AI tech stack, businesses that are application and model focused will need much, if not all, of their computing power to come from infrastructure players – in this case, Cloud Platforms. This is dovetails on top of the “on-premise to cloud migration” that has taken place over the past few decades when companies moved their data center capabilities from on-site facilities to cloud-based infrastructure in droves. Companies pursued this migration in the pursuit of cost savings, connectivity, accessibility, and faster deployment ability, among other factors. Amazon Web Services (AWS), Google Cloud Platform (GCP), and Microsoft Azure are the leading cloud providers and collectively account for 65% of the nearly $250B cloud computing market.

With the Generative AI boon, it’s even more critical that these players invest to stay ahead of the curve. As a16z points out, “these cloud providers collectively spend more than $100 billion per year in capex to ensure they have the most comprehensive, reliable, and cost-competitive platforms.”

So, one has to ask: surely, no one can stop them, right? 🤔

_Enter CoreWeave ⚔️

We covered CoreWeave in Evolving Internet Insights Issue 5, when CoreWeave raised $2.3Bn in debt collateralized by their Nvidia Chips.

CoreWeave is a competitor to the big 3 cloud providers and like all the cloud providers they sell GPU processing power that is required by AI applications and products to scale. Customers effectively “rent” GPU capacity through the cloud. As CoreWeave Chief Strategy Officer Brannin McBee said in a WSJ article, “what we’re doing right now is building the electricity grid for the AI market. If this stuff doesn’t get built, then AI will not be able to scale.” ⚡️

CoreWeave has its origins in cryptocurrency mining, another industry that requires specialized hardware like GPUs to run computation. Its founders started mining cryptocurrency and acquired more and more GPUs as they were looking to scale their operations. At the onset of the crypto winter in 2018/2019, they decided to diversify their business into a few other areas, one of which was AI.

The generative AI boom catalyzed by image models like Stable Diffusion and Mid-Journey and LLMs like ChatGPT significantly increased demand for AI computing power. With its portfolio of AI GPUs that it amassed over time, CoreWeave became one of the winners in a supply constrained industry. As CoreWeave co-founder Brian Venturo said in a WSJ Article, “we had spent $100 million on H100s… but the ChatGPT moment was when I was, like: ‘Everything we’ve thought from a scale perspective may be totally wrong. These people don’t need 5,000 GPUs. They need five million.’”

_How CoreWeave Is Able To Compete With The Giants 🛡

Strategic Backers With Aligned Incentives: Nvidia, the leading AI chipmaker, is an investor in and partner to CoreWeave, giving Coreweave unique access to Nvidia’s highly supply-constrained AI chips. 🤝 As we’ve seen, there are strategic benefits to a startup partnering with another giant. For example, OpenAI has partnered with Microsoft and has received $10B of investment from the tech giant.

In a quickly evolving industry like AI, these strategic partnerships create aligned incentives for different players to address changes in the market together. Since CoreWeave is both a “portfolio company” and a customer to Nvidia, when push comes to shove, Nvidia may prioritize CoreWeave over others.

Aside from the direct benefits of working with Nvidia, CoreWeave has positioned itself to be more than “yet another startup” in the AI space. It recently signed a partnership with Microsoft that could be worth billions of dollars. It was reported that Microsoft signed the deal with CoreWeave to ensure OpenAI, its crown jewel bet, has enough computing capacity to scale. This partnership between “frenemies” (friend x enemy) further complicates the competitive landscape but gives CoreWeave yet another strategic advantage as Microsoft is one of the key players across the entire AI industry.

Staying Nimble As A Startup: CoreWeave scaled its portfolio of GPUs through a series of well-time and opportunistic acquisitions. “One GPU turned into hundreds, then tens of thousands via strategic acquisitions of distressed hardware during the “crypto-winter” of 2018/2019 and our portfolio of facilities grew to seven,” said Michael Intrator, CEO and Co-Founder, in a company blog post. 🦾

As a startup, CoreWeave can take these risky bets in new industries because it's not limited by corporate policies and risk management. And to the credit of tech giants, they have a lot more to lose than CoreWeave.

After building out its portfolio of GPUs, Intrator focused on a common pain point: “legacy cloud providers make it extremely difficult to scale because they offer a limited variety of compute options at monopolistic prices.” Over time, the goal is to offer customers more customized solutions for their specific AI computing needs.

_So What? 🧐

Through its early successes, CoreWeave has raised multiple rounds of financing. Most recently, it raised a $221M Series B and a $2.3B debt facility secured by its lot of Nvidia chips. It’s been reported that the company is looking to raise another equity round at between a $5B and $8B valuation.

CoreWeave is expected to achieve ~$1.5B in revenue in 2024. For context, OpenAI is on track to generate $1B in revenue over the next 12 months and is valued at almost $30B.

At the onset of paradigm shifts in technology, it’s easy to think the incumbent giants will be the clear winners. After all, incumbents are usually more well funded, have larger teams and existing relationships they can sell into.

But as CoreWeave and other startups have proven time and time again, startups are more agile and nimble and can take more risks.

In an exponentially growing market with evolving business models, it’s still largely anyone's game. For an infrastructure player like Coreweave, staying nimble enough to adapt to a volatile market of evolving applications and use cases positions it to ride bigger and bigger waves.

This has allowed CoreWeave to give the incumbents a run for their money and secure its seat at the proverbial table.

⚔️🧒🧌

Additional Readings:

A Startup in the New Jersey Suburbs Is Battling the Giants of Silicon Valley

Nvidia's Best AI Chips Sold Out Until 2024, Says Leading Cloud GPU Provider

Odd Lots: How to Build the Ultimate GPU Cloud to Power AI on Apple Podcasts

SHAMELESS Ask:

🙏 Share Life in Color with a friend and ask them to subscribe

🙏 Share on Twitter / Linkedin with a short note

🙏 Share on your company Slack / Teams channels and communities

🛟 Disclaimer:

This post is provided for educational and informational purposes only. Nothing written in this post should be taken as financial advice or advice of any kind. The author(s) may own some of the NFTs, art and/or collectibles mentioned in this post. The content of this post are the opinions of the authors and not representative of other parties.

Empower yourself, DYOR (do your own research).